Everything Income Tax in 10 Minutes (Who, What, When, Where, Why, How)

The US income tax deadline has been extended by 91 days.

We’re going to break down EVERYTHING income-tax related in just 10 minutes. Including how much you have to pay, where it all came from (and its connection to alcohol), and the easiest way to file (FREE)!

Table of Contents

A Rebel, A Gangster, and Carrie Nation Walk Into a Bar: The History of Income Taxes in America

Good old’ Uncle Sam earns roughly $3.5 TRILLION every year.

Thankfully, he’s somewhat of a philanthropist, giving most of his money away to fund schools, roads, defense, social security, and other public services (much more on this later).

So, where does all his money come from?

He makes a good chunk of change from levying taxes on imports.

He makes a huge chunk of change on payroll taxes. He even moonlights as a middleman between his employees and the public, collecting a bit in fees to make sure the red tape machine is nicely oiled.

But about half of his income comes directly from American citizens themselves.

In fact, 48% of his income comes in the form of income taxes, according to the Tax Policy Center.

That means almost 50 cents of every dollar in his bank account came out of America’s paychecks!

But it hasn’t always been this way….

From The Revolution to the Civil War

Before the Civil War, Uncle Sam made all his money on tariffs, duties, and taxation on alcohol.

But the first “income tax” as we know it today came about during Uncle Sam’s 4-year battle with Johnny Reb in the American Civil War. He was a little strapped for cash, so he levied a 3% tax on incomes over $800 (a lot of money back then!).

Eventually, this act was repealed and nothing much changed until the ratification of the 16th Amendment.

The 16th Amendment and the Road to Prohibition

Congress ratified the 16th Amendment to the US Constitution in 1913, paving the way for the income taxes we pay today.

But wait, hold on. This didn’t just come out of nowhere. Let’s rewind things a bit to the late 19th century.

Late-19th-Century America was a hive of innovation, kind of like it is today. Electricity, railroads, photography, telephones, the paper clip—America either produced these technologies or was the place to make money on them. But all the money was going to a few at the top (sound familiar?).

So, groups began calling for a change to the tax code, claiming that tariffs and alcohol taxes unfairly affected the poor. Many called for a progressive tax code, one where people paid more taxes the more money they made (how income taxes work now).

NEW TERM – Progressive Taxation: A progressive tax is a form of income tax that charges a higher tax rate for higher-income earners. The more you earn the more you pay. This, in theory at least, is designed to make things fairer, because lower-income taxpayers pay a lower percentage.

OK, back to 1913…

The 16th Amendment gave Congress the authority to start levying income taxes. And the only people more excited than the treasury were members of the Temperance Movement (Pro prohibition).

Why?

Because Uncle Sam made 30-40% of his money on alcohol taxes back then. No way would he ever give up 40% of his money, not even for a cause as “righteous” as prohibition.

But with full authority to start charging taxes on each citizen’s earnings, Uncle Sam could easily recoup the money he was about to lose from alcohol sales.

Fun Fact: Prohibition was directly responsible for the rise in power of many mobsters. Men like Al Capone took advantage of bootleg alcohol sales to amass massive wealth, power, and influence. Ironically enough, the very same thing that caused his rise also caused his downfall. Capone was eventually convicted on 3 counts of income tax evasion and sentenced to 11 years in federal prison!

Present Day: Income Tax Bracket Breakdown

The first income tax passed after the 16th Amendment was 1% on incomes over $3,000. Nowadays, things are a bit different.

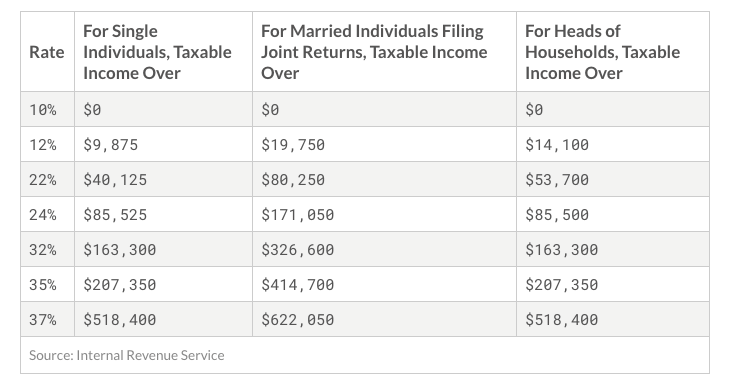

Here’s a basic breakdown of each bracket.

Remember, this is a PROGRESSIVE tax, meaning you only pay that bracket rate for each dollar earned in that bracket.

For example, if you make $40,125 per year, you don’t pay 22% on the ENTIRE sum. You pay 22% on every dollar earned OVER $9,875.

Or, in other words, your first $9,875 is taxed at 12%, your next $30,250 is taxed at 22%, and so on.

Make sense? OK, good.

Now, let’s talk about taking some money off of your taxes (thank God).

What is the 2020 Standard Deduction?

Many expenses you incur along the way to earning your yearly fortune can be deducted from your tax bill.

For example, if you drove to and from work every day, you spent money on your car and gas. That can be deducted.

But that can be a bit tricky…

You’d have to keep receipts every time you fill-up. And you’d have to figure out what your car is actually worth. Hint: it loses value as soon as you drive it off the lot.

So, to make things easier on everyone, Uncle Sam gives you the option to just claim a big chunk of money in one big deduction rather than keeping track of every little item.

So, instead of tracking every gas receipt, every union fee, or every electronic device you use for work, you can just take one lump sum off your taxes to make things easier to calculate.

In 2020, the standard deduction is as follows:

- Single: $12,400

- Married (filing jointly): $24,800

- Head of Household: $18,650

You cannot claim the Standard Deduction if you also submit an itemized deduction.

What Are Capital Gains Taxes?

Not all income is earned from a 9-to-5 grind.

Many Americans earn money from assets such as property, business investments, or even cryptocurrency.

In this case, that income is assessed as a “capital gain” and is taxed at a different rate. Here are the 2020 capital gains tax rates:

So if you purchase a house for $200,000 and sell it for $300,000, you made $100,000. In this case, you don’t owe any taxes on the first $40,000. You do however owe 15% on the next $60,000.

Do I Have to Pay This All at Once? What is a Withholding Tax?

That depends.

Most likely, no. Uncle Sam uses a very effective tactic known as a “withholding” to make things easier on you. Actually, it’s to increase the chances of you paying, but who’s asking us?

Withholding is a technique where your employer takes a small percentage of your pay every week and sends it to Uncle Sam on your behalf. That way, you don’t get hit with a massive bill on April 15th (it’s July 15th this year because of Covid-19).

This also greatly increases the chances of citizens actually paying their tax bills.

F.A.Q – What if I Overpay Throughout the Year?

If your employer pays more to the government on your behalf than you actually owe, Uncle Sam will refund your money. For example, if your employer withheld $5,000 of your salary for taxes, but you end up only owing $4,000, Uncle Sam will send you a $1,000 check.

How to File Your Taxes

Filing your taxes is WAY EASIER than you think it is. It might even be totally free. In fact, Business Insider reports that 70% of Americans can get access to FREE filing via the IRS’ free file portal.

Here’s what the IRS website says. You can file your taxes for free IF “Your Adjusted Gross Income is $69,000 or less, AND your age is between 17 and 51.”

Here’s what you need to know:

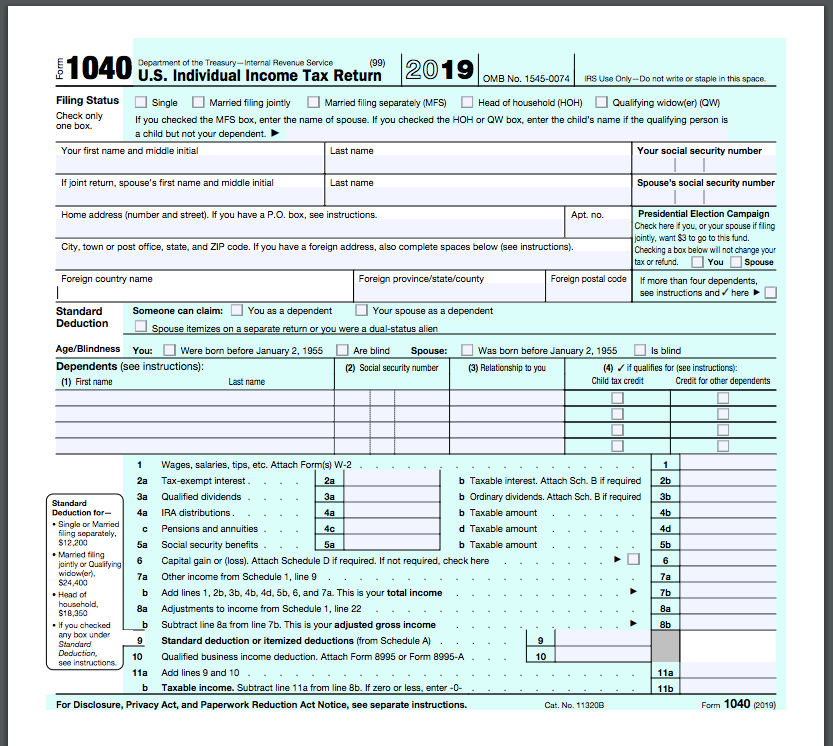

All filers must report their income using 1040.

This requires your personal info like name, address, and Social Security Number. You must also claim your filing status (e.g. single or married).

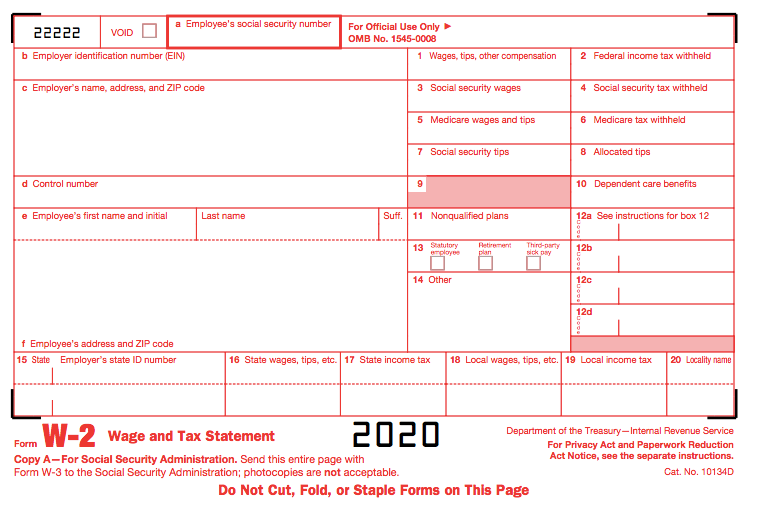

If you have a regular 9-to-5 job, you can find some key information printed right on your W-2.

Your W-2 is the form your employer uses to track your wages and withholdings. They’re obligated to send it to you at tax time. Check your mail!

Use this form to report your wages and deductions. If you have dependents, are filing jointly, are the head of household, or if you have other income streams, this can get complicated. But for the most part, filling in your 1040 is easy.

Once, you’ve filled in the form. Send it electronically or mail it to the IRS.

Helpful Tax Resources

Here are a few resources you can use:

- Free Online Tax Software From the IRS

- Free Tax Preparation From H&R Block

- Easy Online Tax Preparation from Turbo Tax

- Important Filing Information from the IRS

- Filing Instructions from the IRS

Where Does All This Money Go?

It might feel like taxes are “just giving money to the government.” But in reality, it’s more like paying your bill for using public services. The roads you drive on, the power lines that turn your lights on, the plants that clean your water—all of that is funded by tax money. Let’s not even get started on schools, fire departments, or national defense.

Uncle Sam spends the majority of his money providing services to his citizens.

Hopefully, seeing where your tax dollars are going will illustrate how important it is that we all pay our fair share.

According to The Center on Budget Policies and Priorities, here’s a breakdown of Uncle Sam’s main spending habits:

- Social Security (24%): 24 cents out of every tax dollar goes to funding Social Security, our nation’s main safety net. Social Security pays an average of about $1,400 to over 40 million retired workers, as well as disabled citizens and spouses/children of deceased workers. Without these benefits, millions of Americans would go hungry or face hardship.

- Health Care (26%): Medicare, Medicaid, the Children’s Health Insurance Program, and the Affordable Care Act take up a fair chunk of the budget. In a typical month, these programs ensure access to vital health care for 70 MILLION Americans, most of them children, low-income, or disabled.

- Defense (15%): America spends 15% of its budget on defense and security-related activities domestically and around the world.

- Social Safety Net Programs (9%): These are programs OTHER THAN Social Security. For example, free school meals, low-income housing, and the Child Tax Credit.

Other expenses include:

- Benefits for Federal Workers (8%)

- Infrastructure (2%)

- Education (3%)

- Science and Medical Research (2%)

SOURCE (The Center on Budget Policies and Priorities)

Important Tax Due Dates

The US has extended its filing deadlines due to the Coronavirus pandemic.

The new due date is July 15th, 2020.

This applies to ALL TAXPAYERS AUTOMATICALLY.

However, you are encouraged to file as soon as possible in order to get your refund.

NOTE: Most states are conforming to the July 15th deadline but not all. Visit your state’s website to confirm they have extended your tax deadline.

Tax Due Dates Around the World

Keep in mind, this is all subject to change as the Coronavirus pandemic situation continues to evolve.

Canada

Canada HAS EXTENDED its due date for individual filers to JUNE 1st, 2020. All payments MUST BE MADE by September 1st, 2020!

UK

- April 6th, 2020 – The first day of the new tax year

- October 5th, 2020 – Deadline to register for self-assessment

- October 31, 2020 – PAYMENTS ARE DUE!

Australia

- October 31 – You must lodge your self-assessed tax return by this date!

What PDF Software Should I Be Using?

We can’t recommend Soda PDF enough!

If you’re looking to edit, create, convert, merge or split your PDF documents, Soda PDF can help you with our easy-to-use modification tools.

Our Premium product can even help you create and fill out forms, plus you can even add password encryption and secure permissions to your files.

Get a taste of our PDF editing software with a FREE download of our desktop application, or use one of our many online tools from your web browser.