Are you looking to quickly create PDF documents, but do not know which PDF software application is right for you? Perhaps you’re also in need of easy-to-use tools to help you not only create PDF documents for free but also need to edit PDF online or convert multiple documents?

If so, look no further than Soda PDF, the best PDF creator application you’ll find anywhere! Soda PDF has all the features and tools you need to not only create PDF documents but modify them to your specific requirements. Try Soda PDF Desktop or Online today and enjoy our entire suite of PDF tools & services. Get started with a free download of our desktop application and enjoy our easy-to-use tools:

Soda PDF Desktop – Best for Windows

Soda PDF Desktop, available for Windows, is by far the best PDF creator on the market today and best of all: it’s free! You can easily create PDF documents from a variety of file formats, including images or Microsoft Word, Excel, and PowerPoint files. If you need to quickly create PDFs from your scanner, you’ll like using Soda PDF Desktop since this program will automatically transform any scanned document into an editable PDF file in seconds!

Not only is Soda PDF by far the best free PDF creator on the market, but it’s also one of the best PDF editors tool! Soda PDF Desktop is the offline application that has all the PDF editing tools you need to not only create PDFs but can also be used as a PDF reader or can even be used to convert PDF documents to and from a variety of file formats, including Word, Excel, PowerPoint & much more! With a simple user interface, viewing PDF files with this software is not only easy on the eyes but with their 3D page-flipping technology, you can choose to read your PDF format file just like a real book. If you’re a Windows user, then this is the PDF software for you! The best part about Soda PDF Desktop is that it provides easy to use PDF editing tools to modify or change any element of any PDF file.

Soda PDF has the fastest PDF to Office converter tool on the market today. This free PDF editor can help users save time by providing smarter options for managing their documents with ease. Not only does this desktop software run on any version of Windows, but you can also edit PDF files like a Word processor! Even better yet, Soda PDF is loaded with advanced options to make working with documents a simple process. If you’re looking to avoid going to the printer and want to save pages or editing time, then be sure to use this free PDF creator instead.

Soda PDF’s OCR (Optical Character Recognition) tool allows you to search, identify, and edit the text contained within images or scanned documents. Use OCR to give yourself options when tasked with retyping a file that’s already in print, as you’ll find that editing any document in print has never been easier! With Soda PDF’s OCR tool, you can easily create a PDF directly from your scanner, then search for text contained within this “image” file and then edit the contents of the PDF file. That’s right, with Soda PDF OCR, you can say goodbye to needless retyping!

Windows users: are you ready to get started? All you need to do is download the desktop software and create an account in order to enjoy their free version. You’ll then be able to use the best PDF creator to transform your files into editable PDFs in seconds. Create PDFs using the best desktop program for Windows 10 and all other previous versions of Windows. Use the best PDF software for free! Choose Soda PDF Desktop and join the many users like you who were looking for easy features to create, edit, and convert PDF documents. Discover why Soda PDF Desktop is the best PDF editor on the market:

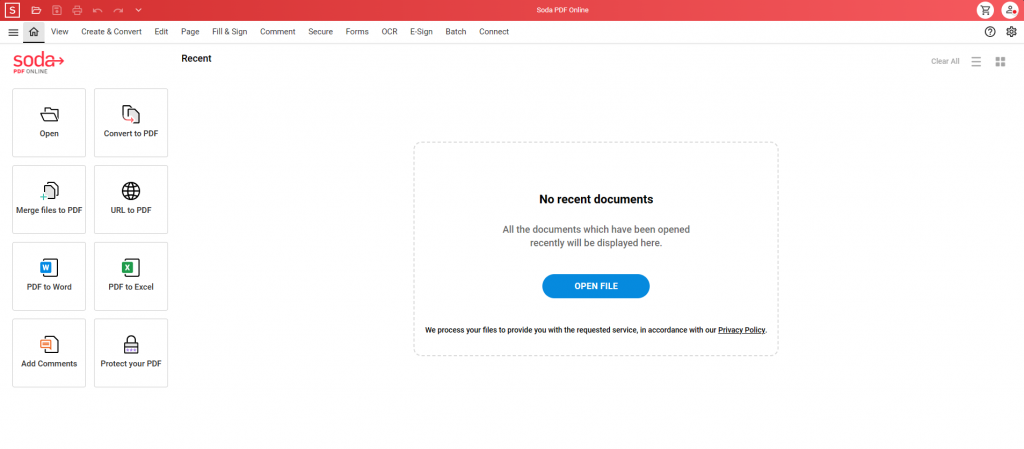

Soda PDF Online – Best for MAC

Are you looking for an online PDF software solution for an operating system that can be run on something other than Windows? If so, Soda PDF Online fits precisely what you’re looking for. We highly suggest this program for MAC users, since this free PDF creator is available online and is accessible from any device with an internet connection. Soda PDF Online has all of the powerful PDF tools users need to make the most of their documents. This online, web browser-based software version is the exact same as Soda PDF Desktop (version 12) and has all of the same options, settings, and interface that you’ll find in the downloadable version.

With Soda PDF Online, you can not only create PDF documents without needing to run Windows, but you can change and adapt PDF files to your needs directly from your iPad, iPhone, or any device with internet access. Furthermore, you can also choose to use other features and tools such as editing PDF text or pages within any PDF file without needing to download a desktop program. Soda PDF Online has all of the options that are included with the Desktop application and also enjoy the same features the same user friendly and easy to navigate interface. Make Soda PDF Online your default PDF editor and change the way you work with PDF files or other documents.

Soda PDF Online also contains all of the advanced options you can find in Soda PDF Desktop, such as E-Sign and OCR. E-Sign will change the way you add legally-binding signatures to your PDF files. By using e-signatures, users are able to add their signature to any PDF file or document just like they would if the signing process was taking place in person. Soda PDF’s E-Sign lets you keep a safe distance between people and paper. Looking to avoid trips to the printer? Do you find yourself going through pages of PDF files looking for inconsistencies? Wish there was an easier way to edit text within images or documents that are already in print? Look no further than Soda PDF’s OCR tool. Use Optical Character Recognition to convert printed pages or documents into editable PDFs in seconds, directly from your scanner! Simply open Soda PDF Online, scan your file, then use OCR to identify editable text within your document pages or images. It’s that easy!

Best of all, since Soda PDF Online is a PDF Creator & PDF Txt Editor, you can easily edit text and images within your PDF file like you would with a Word processor. Whether you’re looking to create, convert, or edit, Soda PDF’s latest software version can help you save time and increase your productivity from anywhere. Plus, using this PDF Creator means you will also save on costs associated with your printer as now you can easily use these powerful PDF tools to avoid retyping by simply using the fully-featured editing tools to modify your documents to your needs. If you’re not a Windows user, or if you simply prefer to work online without needing to download a desktop application, then this is the free PDF editor for you.

PDF Creator – Service Page

Looking for a quick, one-click PDF creator online? If so, we recommend Soda PDF’s free PDF Creator service page. That’s right, Soda PDF doesn’t just offer an Online and Desktop PDF solution, but they also provide one of the best free PDF creator applications as a free service for those who need to quickly create PDF documents in one click.

Unlike the Desktop and Online PDF Creator software, this service page is limited to just creating PDF documents online from your web browser. If you’re looking to edit or add text, best to use either the Soda PDF Online application or Soda PDF Desktop application since this PDF Creator service page is limited to just the tools you need to use to create a PDF document.

Soda PDF’s PDF Creator service page is just one of many one-click PDF solutions for your files. Edit text, convert files, e-sign documents, merge, split, and compress PDFs with paperless solutions aimed to help you digitize files and quickly accomplish your document goals in just a few clicks.

PDF Sam

Another free PDF creator we suggest for Windows users is PDF Sam. Much like Soda PDF, PDF Sam is not only a free PDF creator, but this software program also works for editing documents as well. When comparing PDF Sam to some of the best PDF editors, one PDF software that stands out is Soda PDF due to its simple and friendly user interface. That being said, PDF Sam is still a great program to use if you’re looking to edit, change or modify text like a Word processor, whether it be for one PDF file or many PDFs.

PDF Sam has similar features to Soda PDF Desktop and Soda PDF Online. You can make PDF files directly from your scanner or from various file formats such as Microsoft Word, Excel, and PowerPoint files. This PDF editor makes quick work of your PDF files and this program also lets you convert PDF files to other file formats such as Word, Excel, PowerPoint, and even image files.

PDF Sam is a great option for users who are looking to add a free PDF editor to their slew of software solutions. While PDF Sam has similar features to Soda PDF, such as OCR, this program is still limited to just Windows users. Therefore, this desktop application is only specific to Windows users and therefore they do not offer a text editing solution for MAC users, nor do they have an Online application that can be accessed from any device with an internet connection.

Still, if you’re looking for a basic text editor for your PDFs, PDF Sam can do the job. Edit text, split files, convert file formats, scan a print or and much more. Just keep in mind that PDF Sam is limited to Windows users only, which is why we suggest using Soda PDF instead.

PDF Creator

One last free PDF Creator suggestion would be pdfforge’s very own PDF Creator software. PDF Creator, available for Windows, is one of the free PDF editors on the market today and has all of the settings for editing PDFs or any other document you could wish for.

You can edit text and images within your PDF files and you can even add pages and convert files to other formats. Still, much like PDF Sam, this PDF Creator is limited since the program doesn’t offer an online version for MAC users, whereas a PDF editor like Soda PDF does. If you’re looking for a basic PDF creator, this is the application to use. But if you’re looking to make the most of your PDF documents, then we highly suggest using the best PDF creator and editor around: Soda PDF.

Which FREE PDF CREATOR Should I use?

Of all the free PDF creators & editors on this list, Soda PDF remains the best of the bunch. Whether you’re a Windows user or a MAC user, Soda PDF is the PDF editor you need to quickly edit text in PDFs and to easily manage your files through smarter document solutions.

Are you tired of constantly standing next to the printer and going through countless versions and revisions of documents?

With the fastest PDF to Microsoft Office converter and easily accessible settings, editing PDFs using Soda PDF Desktop or Online will feel like you’re not even working at all! Stop wasting time and paper and do your printer a favor, get the best PDF creator & editor to quickly and easily modify PDF files to your needs: Soda PDF!

Follow Soda PDF on Social Media

Follow us on social media and you just may earn yourself some new PDF knowledge! Subscribe to our YouTube channel to get the latest How-To videos and stay up-to-date with the latest news and special offers from Soda PDF. Soda PDF is also on Twitter and Facebook and often shares PDF industry trends, tips & tricks for working with your documents, tutorial videos for using Soda PDF Online & Desktop, and much more!